Hi,

I have been lucky lately which means that my total portfolio value is up to a new all-time-high of USD 4800...! That was not what I expected when I started in early Feb with USD 2000... :) But, that is how it works, markets give and it takes - I always try to take more when it gives and leave less when it takes... I wish it was that easy...

So, what has happened lately?! Macro continues to disappoint with the flash PMI's out from Europe being horribel, actually the German one was down to the levels not seens since 2009... I guess this is a signal that the austerity in Europe really bites and with that follows less trading within the Eurozone. The Chinese flash PMI (manufacturing data) was also a bit weak, but atleast better than expected. That in combination with the political uncertainity from France and the Nehterlands saw equities fall off cliff on monday... down around -3%. With the Spanish IBEX down to levels not seen since 2003... And, in all this mess I still want to be long EURUSD! Isn't it fascinating that EURUSD hasn't traded lower? (for reasons mentioned in previous posts)... So, I went long EURUSD on both the discretionaty book and the algo book on Monday respectively Sunday. I will keep this positions as for now while I reduced half om my long position in AUDNZD following tonights' FOMC confernce as that cross have seen a decent rebound since the lows and as my convinction is somewhat decreased.

Positions as of today:

Discretionary

It has been a good week so far as all positions have performed, current value USD 550

Long EURUSD (at 1.3152, stop at 1.3065 and target 1.3390)

Long AUDNZD (reduced half at 1.2714)

Long CADJPY

Algo

New all-time-high today (18% return), and in absolute terms without taking into account different weights USD 2250

Long EURUSD (done at 1.3192)

Long GBPJPY

Short USDJPY

Short AUDCAD

Short USDSEK

Wednesday, 25 April 2012

Sunday, 22 April 2012

Weekly update

Hello FX-world!

This week was a pleasent one in terms of USD returns, with GBPJPY being a strong contribution... Strong retail sales and and a reversal of the QE saw the GBP go stronger. It also seems like it was a good decision to close the short position in EURUSD with strong price-action on Friday. Actually, I have had a long signal generated on EURUSD for the first time since I started this blog... Very interesting indeed, and my sense is that positioning is very light for a higher EURUSD (supportive for my trade)... I will try to long this one on the discretionary portfolio as well.

Peformance stills looks strong for the algo (figure on the top) and also the discretionary portfolio managed to post positive numbers...

In terms of USD;

Algo USD 2131 (new high!)

Disc USD 381

Positions:

Algo

Short EURUSD (will change to long as soon as the markets open)

Short USDJPY

Long GBPJPY

Short USDSEK

Short AUDCAD

Disc

Long AUDNZD

Long CADJPY

Long EURUSD (when markets open, going for 2 figures, stops 1.4 figures lower)

Have a nice week!

This week was a pleasent one in terms of USD returns, with GBPJPY being a strong contribution... Strong retail sales and and a reversal of the QE saw the GBP go stronger. It also seems like it was a good decision to close the short position in EURUSD with strong price-action on Friday. Actually, I have had a long signal generated on EURUSD for the first time since I started this blog... Very interesting indeed, and my sense is that positioning is very light for a higher EURUSD (supportive for my trade)... I will try to long this one on the discretionary portfolio as well.

Peformance stills looks strong for the algo (figure on the top) and also the discretionary portfolio managed to post positive numbers...

In terms of USD;

Algo USD 2131 (new high!)

Disc USD 381

Positions:

Algo

Short EURUSD (will change to long as soon as the markets open)

Short USDJPY

Long GBPJPY

Short USDSEK

Short AUDCAD

Disc

Long AUDNZD

Long CADJPY

Long EURUSD (when markets open, going for 2 figures, stops 1.4 figures lower)

Have a nice week!

Thursday, 19 April 2012

Hello, where are you trends?

Hi,

markets are very range-bounds for the moment - which can be quite frustrating with my kind of trading... It is really a relative war out there, with all major countries trying to downplay the value of its currency (Japanese BoJ-member constantly trying weaken the yen by verbal intervention)... And, EurUsd continues to hold the stance despite all bad news out from Europe... Spain falling off a cliff, and even semi-core countries like France and the Netherlands widening in an unhealthy matter. Quite some worrisome developments, but no effect on the Euro... That is why I today decided to close my short EurUsd (sold at 1.3270, closed at 1.3132) since I believe that the capital flows from European countries coming from outside the Eurozone (due to closing down non-core branches etc and taking the money back to the Eurozone) will continue as the deleveraring cycle still has a far way to go. Macro has only a minor impact at the moment. But, I have a sell-order in place if we break below 1.2970 since I believe we will have significant stop-moves from dealers and corporates seeing 1.30 as a big support. Else, Bank of Canada was quite hawkish this week and thus yields have moved up => I have gone long CADJPY...

Current positons:

Discrentionary:

Long AUDNZD*2

Long CADJPY (81.94, stop at 80.45 target 84.2)

Algo

Short EURUSD

Long GBPJPY

Short USDJPY

Short USDSEK

Short AUDCAD

Still no change of signals in AUDNZD and EURCAD

Have a nice time the rest of the week!

Ps. The portfolio value stands at USD 4425 despite the choppy environment Ds.

markets are very range-bounds for the moment - which can be quite frustrating with my kind of trading... It is really a relative war out there, with all major countries trying to downplay the value of its currency (Japanese BoJ-member constantly trying weaken the yen by verbal intervention)... And, EurUsd continues to hold the stance despite all bad news out from Europe... Spain falling off a cliff, and even semi-core countries like France and the Netherlands widening in an unhealthy matter. Quite some worrisome developments, but no effect on the Euro... That is why I today decided to close my short EurUsd (sold at 1.3270, closed at 1.3132) since I believe that the capital flows from European countries coming from outside the Eurozone (due to closing down non-core branches etc and taking the money back to the Eurozone) will continue as the deleveraring cycle still has a far way to go. Macro has only a minor impact at the moment. But, I have a sell-order in place if we break below 1.2970 since I believe we will have significant stop-moves from dealers and corporates seeing 1.30 as a big support. Else, Bank of Canada was quite hawkish this week and thus yields have moved up => I have gone long CADJPY...

Current positons:

Discrentionary:

Long AUDNZD*2

Long CADJPY (81.94, stop at 80.45 target 84.2)

Algo

Short EURUSD

Long GBPJPY

Short USDJPY

Short USDSEK

Short AUDCAD

Still no change of signals in AUDNZD and EURCAD

Have a nice time the rest of the week!

Ps. The portfolio value stands at USD 4425 despite the choppy environment Ds.

Sunday, 15 April 2012

Weekly update - post Easter

Hi!

This week was a very busy one at work, so not a lot of focus of further development the recent days... I continue to follow my daily routines in terms of updating my models according to new signals, but that is it for the moment.

Markets lately have been characterized by range-bound behaviour, and it is really a tug-of war given the major currencies. Macro has continued to come in a bit week, also in the US. But, I still believe the USD looks a bit more interesting relative to the other majors, so I keep my stance for stronger dollar.

Below, the usual update in terms of graphs...

The bad trend in the discretionary portfolio continues... :( While the discretionary portfolio feels really solid - also when considering that equities have performed quite bad lately.

In terms of USD:

Total USD 4180

Algo: USD 1868

Disc: USD 352

Positionwise... I have added to my long AUDNZD position and now runs twice the original size in the discretionary portfolio. I keep my long USDJPY with the stop at 80.40 and the short EURUSD with a stop at 1.3270 and a target below 1.29...

Discr:

Long USDJPY

Short EURUSD

Long AUDNZD

Algo...

I have been forth and back in USDSEK and USDJPY the last week, and the current positioning looks like:

Short EURUSD

Short USDSEK (6,7965)

Short AUDCAD

Long USDJPY (will change to a short position when markets open)

Short GBPJPY

Have a nice one!

This week was a very busy one at work, so not a lot of focus of further development the recent days... I continue to follow my daily routines in terms of updating my models according to new signals, but that is it for the moment.

Markets lately have been characterized by range-bound behaviour, and it is really a tug-of war given the major currencies. Macro has continued to come in a bit week, also in the US. But, I still believe the USD looks a bit more interesting relative to the other majors, so I keep my stance for stronger dollar.

Below, the usual update in terms of graphs...

The bad trend in the discretionary portfolio continues... :( While the discretionary portfolio feels really solid - also when considering that equities have performed quite bad lately.

In terms of USD:

Total USD 4180

Algo: USD 1868

Disc: USD 352

Positionwise... I have added to my long AUDNZD position and now runs twice the original size in the discretionary portfolio. I keep my long USDJPY with the stop at 80.40 and the short EURUSD with a stop at 1.3270 and a target below 1.29...

Discr:

Long USDJPY

Short EURUSD

Long AUDNZD

Algo...

I have been forth and back in USDSEK and USDJPY the last week, and the current positioning looks like:

Short EURUSD

Short USDSEK (6,7965)

Short AUDCAD

Long USDJPY (will change to a short position when markets open)

Short GBPJPY

Have a nice one!

Monday, 9 April 2012

Model trading

As promised... I haven't had so much focus on sharing my models for you - the readers... To be honest - I don't want to share too much since I am a big believer of my models and the "edge" I believe they have... I have been doing this for four years now, spending hundreds (probably thousand) of hours developing/thinking/analyzing different trading approaches... I love this, not for the sake of the money, but for the challenge and the satisfaction it gives when I feel I have understood something a little better. I think this is an ever changing environment, and one can always learn more... The hunt for perfections never stops - that's why I have developed more than 100 models, but only a few feels good enough to trade live in my view. One who has made the cut is the one I am trading on in this challenge.

I will try to describe a little bit better what is behind the model:

The model, let us call it the FX-macro, is based on the relative economic strength between different countries... The rationale are the following, if a country (A) has a strong economic development (increasing GDP, declining unemployment...) vs. a country (B) with weak development (declining GDP, increasing unemployment) then investors should be more interested to invest in A than in B. Since the FX-market is all about demand and supply, then the currency corresponding to country A should be in demand (inflow of capital) while country B's currency should be well supplied (outflow) - implying that the currency A/B should increase in value... What kind of indicator do I use for the economic development in different countries? I use assets from outside the FX-world - mostly rates. This works for me, but somelse may be better off using equities or something else... So, to sum up, if a country is expanding relative to other countries, than it is quite likely that I will be a buyer of the corresponding currency.

I just wanted to include two graphs - highlighting the usual problems as a model trader...

I currently validates an intraday momentum-model which I have developed a couple of years ago... The first graph shows the result when I start in the morning while the other in the afternoon... The difference in result is huge! This seems a bit fishy... :) The first graph is beautiful... Something is wrong, I haven't found out yet (will take some time to go through all code), but this is a usual situation when developing - "learning by burning"...

I will try to describe a little bit better what is behind the model:

The model, let us call it the FX-macro, is based on the relative economic strength between different countries... The rationale are the following, if a country (A) has a strong economic development (increasing GDP, declining unemployment...) vs. a country (B) with weak development (declining GDP, increasing unemployment) then investors should be more interested to invest in A than in B. Since the FX-market is all about demand and supply, then the currency corresponding to country A should be in demand (inflow of capital) while country B's currency should be well supplied (outflow) - implying that the currency A/B should increase in value... What kind of indicator do I use for the economic development in different countries? I use assets from outside the FX-world - mostly rates. This works for me, but somelse may be better off using equities or something else... So, to sum up, if a country is expanding relative to other countries, than it is quite likely that I will be a buyer of the corresponding currency.

I just wanted to include two graphs - highlighting the usual problems as a model trader...

I currently validates an intraday momentum-model which I have developed a couple of years ago... The first graph shows the result when I start in the morning while the other in the afternoon... The difference in result is huge! This seems a bit fishy... :) The first graph is beautiful... Something is wrong, I haven't found out yet (will take some time to go through all code), but this is a usual situation when developing - "learning by burning"...

Happy Easter - weekly update

Hi!

I hope you have enjoyed some days off! I have had some busy days, which means that I haven't had time to finish some of my development projects... However, I will today post twice, first the weekly update and then a post focusing on the models...

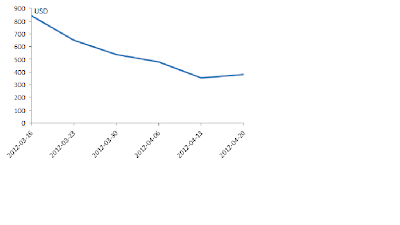

So, see below for the regular weekly update... The first graph is the development of my algo on a daily basis as %. The second graph is the development of the discretionary portfolio starting three weeks ago and updating weekly...

The devlopment for the discretionary porfolio is declining hefty, now down to "only" USD 481 while the algo is up towards a new high (USD 1839) => total profit USD 4280

My model-based approach has worked really good given the declining equity markets - eventhough I have been short USDSEK and long USDJPY, which usually declines when risky assets drop. I hadn't expected this decline in risky assets when taking into acccount the macro developments worldwide. Manufacturing orders came in strong globally except for Europe, and consumers continue to be relative optimistic. However, the weak payrolls report on Friday was a bit worrisome and the detoriating development in Spain - I guees we will have a volatile ride the coming week. I still believe the USD looks relative stronger than the other majors, but I still want yields to be supportive so I keep an open stance at the moment. Else, I have been stopped out from a long position in EURCHF twice, I still believe in the case, but it is also quite obvious that many others share my view... So I keep a square position at the moment. I believe that EURUSD will trend lower (US looks relative stronger than the Eurozone, which can be seen in the manufacturing production and the genereal macro-outlook).

To sum up:

Discretionary positions

Long USDJPY (stop at 80.40, entered at 79.56)

Short EURUSD (Moved stop down to entry-level, 1.3270 and target down to 1.2835)

Long AUDNZD (Traded at 6 months low, feels a bit "overdone" given the stronge correlation to China)

Algo

Long USDJPY (quite likely to have a sell-signal generated tomorrow)

Short GBPJPY

Short EURUSD

Long USDSEK (entered at 6.7734)

Short AUDCAD

Have a wonderful week!

I hope you have enjoyed some days off! I have had some busy days, which means that I haven't had time to finish some of my development projects... However, I will today post twice, first the weekly update and then a post focusing on the models...

So, see below for the regular weekly update... The first graph is the development of my algo on a daily basis as %. The second graph is the development of the discretionary portfolio starting three weeks ago and updating weekly...

The devlopment for the discretionary porfolio is declining hefty, now down to "only" USD 481 while the algo is up towards a new high (USD 1839) => total profit USD 4280

My model-based approach has worked really good given the declining equity markets - eventhough I have been short USDSEK and long USDJPY, which usually declines when risky assets drop. I hadn't expected this decline in risky assets when taking into acccount the macro developments worldwide. Manufacturing orders came in strong globally except for Europe, and consumers continue to be relative optimistic. However, the weak payrolls report on Friday was a bit worrisome and the detoriating development in Spain - I guees we will have a volatile ride the coming week. I still believe the USD looks relative stronger than the other majors, but I still want yields to be supportive so I keep an open stance at the moment. Else, I have been stopped out from a long position in EURCHF twice, I still believe in the case, but it is also quite obvious that many others share my view... So I keep a square position at the moment. I believe that EURUSD will trend lower (US looks relative stronger than the Eurozone, which can be seen in the manufacturing production and the genereal macro-outlook).

To sum up:

Discretionary positions

Long USDJPY (stop at 80.40, entered at 79.56)

Short EURUSD (Moved stop down to entry-level, 1.3270 and target down to 1.2835)

Long AUDNZD (Traded at 6 months low, feels a bit "overdone" given the stronge correlation to China)

Algo

Long USDJPY (quite likely to have a sell-signal generated tomorrow)

Short GBPJPY

Short EURUSD

Long USDSEK (entered at 6.7734)

Short AUDCAD

Have a wonderful week!

Tuesday, 3 April 2012

Bingo! FOMC-minutes

Hello,

The FOMC minutes released this evening supports my case for stronger USD as the members are less convinced that further policy measures are needed given the current state of the economy. Price-action the last week(s), meaning weaker dollar, points to a belief that further quantitative easing (QE3) would be realitiy, which has also been visible in the declining yields lately. This will probably now change. I think that the information out tonight could potentially lead to a continued increase in yields short/medium term, which means that I continue to see a fundamental case for stronger dollar. So, no change to my current positioning (Long USDJPY, short EURUSD).

The total portfolio value at this time: USD 4254 :) - a good number eventhough I have been stopped out of USDJPY a couple of times lately... (I need to place my stops outside the obvious support-areas)

Have a nice easter!

The FOMC minutes released this evening supports my case for stronger USD as the members are less convinced that further policy measures are needed given the current state of the economy. Price-action the last week(s), meaning weaker dollar, points to a belief that further quantitative easing (QE3) would be realitiy, which has also been visible in the declining yields lately. This will probably now change. I think that the information out tonight could potentially lead to a continued increase in yields short/medium term, which means that I continue to see a fundamental case for stronger dollar. So, no change to my current positioning (Long USDJPY, short EURUSD).

The total portfolio value at this time: USD 4254 :) - a good number eventhough I have been stopped out of USDJPY a couple of times lately... (I need to place my stops outside the obvious support-areas)

Have a nice easter!

Sunday, 1 April 2012

Arghh... Sunday pushed my stop

Hi...!

A bit annoyed at the moment. Markets just opened, and my stop on EURCHF was triggered just because it was a wide bid/offer spread on open (I had used a trigger on bid, I will never do that again).

Anyways, I had a great weekend... Hopefully you did as well. :)

Short recap, see updated P/L for the algo down below.

Algo: USD 1480

Discr. USD 548

As you can see, the algo increased the lead last week... I have to come up with something special quite soon. :)

Well, marketswise...The Japanese fiscal year has just ended, and the usual saying is that is usually bad news for the Yen. I am not sure about that, but all my models are pointing to weaker fundamentals for the Yen - USDJPY continues to look interesting with still quite solid macro in the US. So, I keep my call for stronger USD vs. JPY.

Positions:

Discretionary:

Long 2*USDJPY (I was stopped out on position this week, but just added another here at 83.04 - stop 81,97, target 84,75)

Short EURUSD

Long EURCHF (added a new position after my annoying stop - still stop at 1,2022 but trigger on offer)

Algo.

Long USDJPY

Short AUDCAD

Short EURUSD

Short USDSEK

Short GBJPY (just went short 132,984 after three days of whip-saw, and for once a profitable whip-saw)...

That's all for this time...

A bit annoyed at the moment. Markets just opened, and my stop on EURCHF was triggered just because it was a wide bid/offer spread on open (I had used a trigger on bid, I will never do that again).

Anyways, I had a great weekend... Hopefully you did as well. :)

Short recap, see updated P/L for the algo down below.

Algo: USD 1480

Discr. USD 548

As you can see, the algo increased the lead last week... I have to come up with something special quite soon. :)

Well, marketswise...The Japanese fiscal year has just ended, and the usual saying is that is usually bad news for the Yen. I am not sure about that, but all my models are pointing to weaker fundamentals for the Yen - USDJPY continues to look interesting with still quite solid macro in the US. So, I keep my call for stronger USD vs. JPY.

Positions:

Discretionary:

Long 2*USDJPY (I was stopped out on position this week, but just added another here at 83.04 - stop 81,97, target 84,75)

Short EURUSD

Long EURCHF (added a new position after my annoying stop - still stop at 1,2022 but trigger on offer)

Algo.

Long USDJPY

Short AUDCAD

Short EURUSD

Short USDSEK

Short GBJPY (just went short 132,984 after three days of whip-saw, and for once a profitable whip-saw)...

That's all for this time...

Subscribe to:

Comments (Atom)