Hi!

Very short update - low activity in the discretionary portfolio due to my view that I think we need to get to the end of August until any material trends will take place (except for the ones in EUR and SEK). The algo has recovered lately and is close to taking out its old highs. Being short USDSEK has played out nice lately and the long EURUSD looks interesting and is definitely not a populated trade.

Update live result:

Current positions:

Long EURUSD

Short USDSEK

Square AUDCAD

Short GBPJPY

Short USDJPY

Have a nice week!

Ps. I will be off for three weeks starting on Friday Ds.

Monday, 30 July 2012

Sunday, 22 July 2012

Update

Markets are still characterized by low liquidity and much "noise".

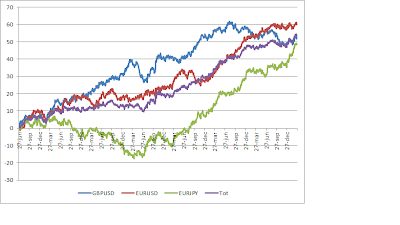

I finished a short-term break-out model (as mentioned in the last update) on EurUsd, GbpUsd and EurJpy, the next step will be to fully automate the system using MetaTrader 4 - a completely new experience for me. See graph below for back-test (including slippage and transaction costs). I look forward to have it up and running, but I have no idea how long time it will take make the code robust . My motivation is increasing week for week, it is such a great feeling to finish a model which you spent a lot of time developing (the thing that take most time for me tends to be the "thinking", creating a mental game plan that I trust can work not only today, but also in five, ten years down the road).

Not much going on in the competition... Starting with the "algo", Small up since the last update with the most notable being that the short position in AudCad has been stopped out and the model is now sqaure in this currency pair.

See below for updated live performance;

Current positions:

Short EURUSD

Long USDSEK

Short GBPJPY

Short USDJPY

The discretionary portfolio:

I was long USDSEK for one day the last week as my indicator gave long signal, but closed it the day after with a marginal profit - no other positions taken lately, or in the portfolio. Feels OK to have low (or no) exposure at the moment given thelow activities in markets.

Have nice week!

Ps. I booked tickets to Vegas in August - will be great fun! Ds.

I finished a short-term break-out model (as mentioned in the last update) on EurUsd, GbpUsd and EurJpy, the next step will be to fully automate the system using MetaTrader 4 - a completely new experience for me. See graph below for back-test (including slippage and transaction costs). I look forward to have it up and running, but I have no idea how long time it will take make the code robust . My motivation is increasing week for week, it is such a great feeling to finish a model which you spent a lot of time developing (the thing that take most time for me tends to be the "thinking", creating a mental game plan that I trust can work not only today, but also in five, ten years down the road).

Not much going on in the competition... Starting with the "algo", Small up since the last update with the most notable being that the short position in AudCad has been stopped out and the model is now sqaure in this currency pair.

See below for updated live performance;

Current positions:

Short EURUSD

Long USDSEK

Short GBPJPY

Short USDJPY

The discretionary portfolio:

I was long USDSEK for one day the last week as my indicator gave long signal, but closed it the day after with a marginal profit - no other positions taken lately, or in the portfolio. Feels OK to have low (or no) exposure at the moment given thelow activities in markets.

Have nice week!

Ps. I booked tickets to Vegas in August - will be great fun! Ds.

Sunday, 15 July 2012

Summer... :)

Hi!

Busy summer, busy at work, busy at home. Enough said, that is a luxury - so I will spare you from my whining.

Markets are typical for this time of the year, low liquidity and no real trends (except for Fixed Income - yields just continue downwards), well the Euro is still weakning but I dont want to chase it so far into a trend. In terms of macro, not good but not so bad either. It feels like we are in some sort of vacuum and I guess the real deal will start in Aug/Sep. Many leading indicators still declines - like the manufacturing index, but it more seems like a soft patch and jobs data are still quite robust. I am suprised that volatility is so low (VIX is megalow when comparing to earlier periods when risky assets are in a decline). Earnings season have started off in a good way, with JPMorgon coming strong on Friday - but investors still dislike risky assets and the hunt for yield in Fixed Income push yields into negative readings. This is really no easy markets, and my favorite discipline in the Hedge Fund world have had a very tough and bumpy summer. CTA's (systematic strategies) posted losses as high as -5%/-6% on the last day of June, and they were not the only ones. This have been a good period for testing my model, and I can soon book my first half year (early August) with a profit - atleast as it looks right now. I am very pleased, and motivation have been high lately even though time is scarce when combining a hectic life on work and still wanting time for all the social events popping up during summer.

So, I have spent hours (and some more hours) finishing a model I mentioned here a couple of months ago. It is a day-trading model which tries to capture moment Break-Outs. Testing looks promising, and I have actually traded on similar strategy at work a couple of years back (with good results).

See graph down below for 5 years of backtesting on EURUSD. (I will start to trade it in this contest this week). Don't put to much into to the different numbers on the x- and y-axis, rather judge it on the slope... :)

So, what about the competition?! It is still alive... Yes!

I tried some different positions in the discretionary portfolio lately - all tilted to a bounce back in risky assets but with no success: Long EurUsd, Long GbpUsd and Long CADJPY, the last two were stopped out while I closed the first one only after one day due to price action and change of signal on my fundamental indicator.

I am currently square, but I can promise you that I will have taken on new positons before the week is over. :)

PnL-developments:

Finally - the algo:

It has been choppy lately, I have been forth and back the last two weeks in EurUsd, UsdSek and AudCad while the the positions versus Yen have been static (short UsdJpy, Short GbpJpy).

Current trades look like:

Short EURUSD

Short USDSEK

Short AUDCAD

Short GBPJPY

Short USDJPY

=> Majority of the positions performs in a risk-off scenario.

PnL:

Have a nice late night and lovely new week!

Busy summer, busy at work, busy at home. Enough said, that is a luxury - so I will spare you from my whining.

Markets are typical for this time of the year, low liquidity and no real trends (except for Fixed Income - yields just continue downwards), well the Euro is still weakning but I dont want to chase it so far into a trend. In terms of macro, not good but not so bad either. It feels like we are in some sort of vacuum and I guess the real deal will start in Aug/Sep. Many leading indicators still declines - like the manufacturing index, but it more seems like a soft patch and jobs data are still quite robust. I am suprised that volatility is so low (VIX is megalow when comparing to earlier periods when risky assets are in a decline). Earnings season have started off in a good way, with JPMorgon coming strong on Friday - but investors still dislike risky assets and the hunt for yield in Fixed Income push yields into negative readings. This is really no easy markets, and my favorite discipline in the Hedge Fund world have had a very tough and bumpy summer. CTA's (systematic strategies) posted losses as high as -5%/-6% on the last day of June, and they were not the only ones. This have been a good period for testing my model, and I can soon book my first half year (early August) with a profit - atleast as it looks right now. I am very pleased, and motivation have been high lately even though time is scarce when combining a hectic life on work and still wanting time for all the social events popping up during summer.

So, I have spent hours (and some more hours) finishing a model I mentioned here a couple of months ago. It is a day-trading model which tries to capture moment Break-Outs. Testing looks promising, and I have actually traded on similar strategy at work a couple of years back (with good results).

See graph down below for 5 years of backtesting on EURUSD. (I will start to trade it in this contest this week). Don't put to much into to the different numbers on the x- and y-axis, rather judge it on the slope... :)

So, what about the competition?! It is still alive... Yes!

I tried some different positions in the discretionary portfolio lately - all tilted to a bounce back in risky assets but with no success: Long EurUsd, Long GbpUsd and Long CADJPY, the last two were stopped out while I closed the first one only after one day due to price action and change of signal on my fundamental indicator.

I am currently square, but I can promise you that I will have taken on new positons before the week is over. :)

PnL-developments:

Finally - the algo:

It has been choppy lately, I have been forth and back the last two weeks in EurUsd, UsdSek and AudCad while the the positions versus Yen have been static (short UsdJpy, Short GbpJpy).

Current trades look like:

Short EURUSD

Short USDSEK

Short AUDCAD

Short GBPJPY

Short USDJPY

=> Majority of the positions performs in a risk-off scenario.

PnL:

Have a nice late night and lovely new week!

Sunday, 1 July 2012

Congrats Spain!

What a MACHINE - Spain!

I had my hopes for an Italian victory, but it wasn't even close.

A very short update, I am off to London tomorrow for a trading conference (focusing on Fixed Income), but will be back on Thursday. Sorry for my infrequent postings lately! But as I always say, I continue to take my signals every day eventhough I dont post here. I also managed to find some time to do some programming lately, I continue to validate a break-out model (looks promising)... More to come on that subject - hopefully. :)

The algo have had some diffuculties lately, but is still up significantly this year, see chart below.

The current positions look like;

Algo

Long EURUSD

Long AUDCAD

Short USDSEK

Short USDJPY

Short GBPJPY

So, all-in-all a quite mixed porfolio in terms of risk on/off.

Discr

No positions active but a new all-time high. :)

Lately I have tried to short GBPUSD (Stopped out with a loss of around USD -160) and go long EURUSD (profit of USD 250). The long EURUSD was based on that I thought way too much negative was priced into the price going into the EU summit (Merkel downplayed all market expectations in a clever way), but I was very close to ger stoppped out. I entered with two units, one at 1.25 and the other one at 1.2445, both with stops at 1.2395... Low was 1.2407. So very lucky indeed. I closed it early Friday at 1.2587. I wont take any new trades this week since I will be away.

Over and out!

I had my hopes for an Italian victory, but it wasn't even close.

A very short update, I am off to London tomorrow for a trading conference (focusing on Fixed Income), but will be back on Thursday. Sorry for my infrequent postings lately! But as I always say, I continue to take my signals every day eventhough I dont post here. I also managed to find some time to do some programming lately, I continue to validate a break-out model (looks promising)... More to come on that subject - hopefully. :)

The algo have had some diffuculties lately, but is still up significantly this year, see chart below.

The current positions look like;

Algo

Long EURUSD

Long AUDCAD

Short USDSEK

Short USDJPY

Short GBPJPY

So, all-in-all a quite mixed porfolio in terms of risk on/off.

Discr

No positions active but a new all-time high. :)

Lately I have tried to short GBPUSD (Stopped out with a loss of around USD -160) and go long EURUSD (profit of USD 250). The long EURUSD was based on that I thought way too much negative was priced into the price going into the EU summit (Merkel downplayed all market expectations in a clever way), but I was very close to ger stoppped out. I entered with two units, one at 1.25 and the other one at 1.2445, both with stops at 1.2395... Low was 1.2407. So very lucky indeed. I closed it early Friday at 1.2587. I wont take any new trades this week since I will be away.

Over and out!

Sunday, 24 June 2012

Vacation - all targets hit

Hi,

just a really short update since I have been away on vacation (Beautiful Sweden)...

For the ones following the blog more carefully, then you are aware that all my profit targets were hit this week. :) The positioning for stronger AUD realized, and both AUDCAD and EURAUD hit my targets of 1.04 and 1.24, respectively. Implying that the competition is acutally alive again, the discretionary portfolio is upp USD 1400 while the algo had suffered lately. I will do the graphical update as soon as I settled again.

But all in all - no positions active in the discretionary portfolio. I hope this will change the coming week, the JPY seems to be suffering a bit lately and I may consider following the trend.

over and out (When Sweden is out of the cup, well then Goooo Italy)

just a really short update since I have been away on vacation (Beautiful Sweden)...

For the ones following the blog more carefully, then you are aware that all my profit targets were hit this week. :) The positioning for stronger AUD realized, and both AUDCAD and EURAUD hit my targets of 1.04 and 1.24, respectively. Implying that the competition is acutally alive again, the discretionary portfolio is upp USD 1400 while the algo had suffered lately. I will do the graphical update as soon as I settled again.

But all in all - no positions active in the discretionary portfolio. I hope this will change the coming week, the JPY seems to be suffering a bit lately and I may consider following the trend.

over and out (When Sweden is out of the cup, well then Goooo Italy)

Sunday, 17 June 2012

The Greek tragedy

Hi folks!

Sorry for not posting for a while, but don't worry I continue to update my models day after day, year after year (atleast day after day). The Greek election could potentially have major implications on markets but I am cautiously optimistic as I think New Democrazy will win but it is close to a coin-flip. I have tried to be prudent and reduced some holdings in the discretionary portfolio before the weekend (-1 unit of AUDCAD). Actually, the discretionary portfolio have had a nice development latley, as my call for a stronger AUD has played out and also being lucky trading EURUSD in a profitable way after the Spanish bank aid request (sold on the sunday above 1.26 and then turned the position to a long below 1.25).

The algo have seen som volatility lately, but the discretionary book have been off-setting this in a nice way.

I also tried the short USDSEK at the same time as I shorted EURUSD but decided to stop it out early.

Else, I still think AUD could strengthen a bit further, macro and fundamentals continue to be supportive.

Positions:

Discretionaty portfolio: (New all-time high, above USD 1100)

Short EURAUD (Entry 1.292, stop at 1.282, target 1.24)

Long AUDCAD (Entry 1.0057, target 1.04, stop at 1.012) - reduced one unit at 1.026

Algo:

Long EURUSD (from 1.2505)

Short USDSEK (from 7.13)

Short USDJPY

Short GBPJPY

Short AUDCAD

Have a nice week!

Sorry for not posting for a while, but don't worry I continue to update my models day after day, year after year (atleast day after day). The Greek election could potentially have major implications on markets but I am cautiously optimistic as I think New Democrazy will win but it is close to a coin-flip. I have tried to be prudent and reduced some holdings in the discretionary portfolio before the weekend (-1 unit of AUDCAD). Actually, the discretionary portfolio have had a nice development latley, as my call for a stronger AUD has played out and also being lucky trading EURUSD in a profitable way after the Spanish bank aid request (sold on the sunday above 1.26 and then turned the position to a long below 1.25).

The algo have seen som volatility lately, but the discretionary book have been off-setting this in a nice way.

I also tried the short USDSEK at the same time as I shorted EURUSD but decided to stop it out early.

Else, I still think AUD could strengthen a bit further, macro and fundamentals continue to be supportive.

Positions:

Discretionaty portfolio: (New all-time high, above USD 1100)

Short EURAUD (Entry 1.292, stop at 1.282, target 1.24)

Long AUDCAD (Entry 1.0057, target 1.04, stop at 1.012) - reduced one unit at 1.026

Algo:

Long EURUSD (from 1.2505)

Short USDSEK (from 7.13)

Short USDJPY

Short GBPJPY

Short AUDCAD

Have a nice week!

Wednesday, 6 June 2012

Sell in May and then go away...

So, the old saying "Sell in May and then go away" have been true so far on the equity markets... May was a horrible month for risky assets in general, and maybe not a major surprise in hindsight given the detoriating macro and political outlook. However, this is the environment where my FX macro model is designed to benefit the most, and thus acting as a hedge to a portfolio tilted to "long-only"... And so it did. I have now been trading it live for four months and the performance and robustnees have (so far ) been stronger than expected. I expect it to have a tough ride when investment sentiment appear in markets again, but I try to enjoy while it last... Markets gives and takes, and adopting a objective systematic trading strategy can be really relaxing sometimes.

I have also taken control of my discretionary portfolio again and the Short EurAud entered earlier now have a friend, namely a long position in AudCad. I entered it on the 1st of June at 1.00575 on the back of central bank expectations, markets expected Bank of Australia to cut with -1.3% the coming year while Bank of Canada was expected to increase rates with 0.1%... I thought this was overdone, and I had to try a long position given the low of the year in this cross. Actually, I took on a position three times my regulary due to strong conviction. It has played out good so far, but I try to stay objective and have therefor already reduced 1/3 (at 1.0194) and moved my stop to entry. So, my take for now, and given strong GDP from Australia is for a stronger AUD... I am tempted to short JPY as well (as usual), but are still sidelined. Especially a long postion in SEK vs. JPY looks very interesting longer term! (Take a look on a chart)

Performance update, see graphs... I have included a comparison to equities in a try to show the diversification effect.

The discretionary portfolio - a gain of USD 450 since the last update (thanks to Aussie)

I have also taken control of my discretionary portfolio again and the Short EurAud entered earlier now have a friend, namely a long position in AudCad. I entered it on the 1st of June at 1.00575 on the back of central bank expectations, markets expected Bank of Australia to cut with -1.3% the coming year while Bank of Canada was expected to increase rates with 0.1%... I thought this was overdone, and I had to try a long position given the low of the year in this cross. Actually, I took on a position three times my regulary due to strong conviction. It has played out good so far, but I try to stay objective and have therefor already reduced 1/3 (at 1.0194) and moved my stop to entry. So, my take for now, and given strong GDP from Australia is for a stronger AUD... I am tempted to short JPY as well (as usual), but are still sidelined. Especially a long postion in SEK vs. JPY looks very interesting longer term! (Take a look on a chart)

Performance update, see graphs... I have included a comparison to equities in a try to show the diversification effect.

The FX algorithm - in %

That's all for this time folk's!

Ps. Positioning...

Algo:

Long USDSEK

Short EURUSD

Short GBPJPY

Short USDPY

Short AUDCAD

"try-out"

Long EURCAD

Short AUDNZD

Disccretionary:

Short EURAUD (target 1.24, stop 1.292)

Long AUDCAD (target 1.04, stop 1.0058)

Ds.

Subscribe to:

Posts (Atom)