Hello!

Once upon time... I posted three times a week. :) Well, sorry for not posting since my vaction - bad habits! Anyway, it was a fantastic vacation, when not enjoying the sun, nice wine and good company, then I took the oppurtunity to spend three full days working on my models and starting drafting on an investor presentation. The latter is actually finished now (after some long nights and good inputs from friends - thanks!), eventhough some changes stills needs to be done to sharpen the presentation further. E-mail me if you want to see it.

So - what about the competitioen, is it still alive? Indeed! However, I havent had time to update the graphical returns just yet, but the algo is performing much better than my discretionary bets at the moment. Update will come - have patience!

In terms of markets, tons of things have happened the last month. The three major central banks have gone "all-in", which effective have put a floor on risky assets (they will take action if markets move in the wrong direction). At the same time the bad/modest macro outlook have put a cap on the upside, it simple needs to improve before risky assets more seriously can start climbing. Meanwhile, I expect rangetrading with a tilt to stronger risky assets (higher equity markets etc). How does this translates into FX? I think the JPY will underperform, NOKSEK higher and more longterm a lower EURUSD.

Over and out!

Sunday, 30 September 2012

Sunday, 19 August 2012

Vacation - road trip

Hi!

I am in the US - so no updates and the next one can be expected within 14 days. Performance continue to be good, EurJpy hit its target and the algo is short the JPY across the board. The coming week will be the first time ever when I wont be able to update my model, so performance can be expected to be a bit erratic.

All the best!

I am in the US - so no updates and the next one can be expected within 14 days. Performance continue to be good, EurJpy hit its target and the algo is short the JPY across the board. The coming week will be the first time ever when I wont be able to update my model, so performance can be expected to be a bit erratic.

All the best!

Monday, 6 August 2012

Happy birthday! New all-time high

Well... Sorry for the confusing headline, but it is actually a sort of a birthday - it is 6 months since I started this blog. 6 months passes by in a second - it has not always been an easy ride, but the result have by far exceeded all my expectations. Actually, the algo (my macro model) posted a new ALL-TIME high last week, up approx. 45% since inception. The best thing lately have been to see that it is not only negatively correlated to risk, it also managed to perform strongly when equities did the same (like last week) - firming up the use for the model as it seems to show quite low correlation with equities.

What about the discretionaty portfolio? - Well, minor activity lately, but I took on two new positions last week following the ECB-meeting (where I though the market reaction was a bit "too much"). Long EurJpy and Short AudCad. I stopped (with a small loss USD -55) the short position in AudCad late last week since my macro model changed signal while increased my stop in EurJpy above entry (Entry 95.3 - stop at 95.5, target 98.1). ECB's Draghi disappointed markets by not introducing any new non-standard meausers, however, between the lines he said it was on the table - and quite soon as well. So the negative market reaction felt a bit overdone. Else, the strong Aud and Sek feels toxic, but nothing I want to take positions against as of now. I wouldn't want to chase a short position in EUR at these levels, short-squeezes could potentiall be nasty!

But for now - activity wil be low. I have just started my vacation and I will be traveling a lot. First of to London and the olypmics, and then the US for first a week in Vegas and then a roadtrip to San Fransisco. I will try to keep you tuned.

Performance, please see below:

Current positions:

Algo

Short EURUSD

Short USDSEK

Long AUDCAD

Short GBPJPY

Short USDJPy

Discretionary

Long EURJPY

That is it for now!

Take care my dear six-months friends

What about the discretionaty portfolio? - Well, minor activity lately, but I took on two new positions last week following the ECB-meeting (where I though the market reaction was a bit "too much"). Long EurJpy and Short AudCad. I stopped (with a small loss USD -55) the short position in AudCad late last week since my macro model changed signal while increased my stop in EurJpy above entry (Entry 95.3 - stop at 95.5, target 98.1). ECB's Draghi disappointed markets by not introducing any new non-standard meausers, however, between the lines he said it was on the table - and quite soon as well. So the negative market reaction felt a bit overdone. Else, the strong Aud and Sek feels toxic, but nothing I want to take positions against as of now. I wouldn't want to chase a short position in EUR at these levels, short-squeezes could potentiall be nasty!

But for now - activity wil be low. I have just started my vacation and I will be traveling a lot. First of to London and the olypmics, and then the US for first a week in Vegas and then a roadtrip to San Fransisco. I will try to keep you tuned.

Performance, please see below:

Current positions:

Algo

Short EURUSD

Short USDSEK

Long AUDCAD

Short GBPJPY

Short USDJPy

Discretionary

Long EURJPY

That is it for now!

Take care my dear six-months friends

Monday, 30 July 2012

Closing in on the highs

Hi!

Very short update - low activity in the discretionary portfolio due to my view that I think we need to get to the end of August until any material trends will take place (except for the ones in EUR and SEK). The algo has recovered lately and is close to taking out its old highs. Being short USDSEK has played out nice lately and the long EURUSD looks interesting and is definitely not a populated trade.

Update live result:

Current positions:

Long EURUSD

Short USDSEK

Square AUDCAD

Short GBPJPY

Short USDJPY

Have a nice week!

Ps. I will be off for three weeks starting on Friday Ds.

Very short update - low activity in the discretionary portfolio due to my view that I think we need to get to the end of August until any material trends will take place (except for the ones in EUR and SEK). The algo has recovered lately and is close to taking out its old highs. Being short USDSEK has played out nice lately and the long EURUSD looks interesting and is definitely not a populated trade.

Update live result:

Current positions:

Long EURUSD

Short USDSEK

Square AUDCAD

Short GBPJPY

Short USDJPY

Have a nice week!

Ps. I will be off for three weeks starting on Friday Ds.

Sunday, 22 July 2012

Update

Markets are still characterized by low liquidity and much "noise".

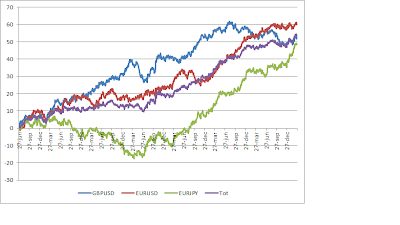

I finished a short-term break-out model (as mentioned in the last update) on EurUsd, GbpUsd and EurJpy, the next step will be to fully automate the system using MetaTrader 4 - a completely new experience for me. See graph below for back-test (including slippage and transaction costs). I look forward to have it up and running, but I have no idea how long time it will take make the code robust . My motivation is increasing week for week, it is such a great feeling to finish a model which you spent a lot of time developing (the thing that take most time for me tends to be the "thinking", creating a mental game plan that I trust can work not only today, but also in five, ten years down the road).

Not much going on in the competition... Starting with the "algo", Small up since the last update with the most notable being that the short position in AudCad has been stopped out and the model is now sqaure in this currency pair.

See below for updated live performance;

Current positions:

Short EURUSD

Long USDSEK

Short GBPJPY

Short USDJPY

The discretionary portfolio:

I was long USDSEK for one day the last week as my indicator gave long signal, but closed it the day after with a marginal profit - no other positions taken lately, or in the portfolio. Feels OK to have low (or no) exposure at the moment given thelow activities in markets.

Have nice week!

Ps. I booked tickets to Vegas in August - will be great fun! Ds.

I finished a short-term break-out model (as mentioned in the last update) on EurUsd, GbpUsd and EurJpy, the next step will be to fully automate the system using MetaTrader 4 - a completely new experience for me. See graph below for back-test (including slippage and transaction costs). I look forward to have it up and running, but I have no idea how long time it will take make the code robust . My motivation is increasing week for week, it is such a great feeling to finish a model which you spent a lot of time developing (the thing that take most time for me tends to be the "thinking", creating a mental game plan that I trust can work not only today, but also in five, ten years down the road).

Not much going on in the competition... Starting with the "algo", Small up since the last update with the most notable being that the short position in AudCad has been stopped out and the model is now sqaure in this currency pair.

See below for updated live performance;

Current positions:

Short EURUSD

Long USDSEK

Short GBPJPY

Short USDJPY

The discretionary portfolio:

I was long USDSEK for one day the last week as my indicator gave long signal, but closed it the day after with a marginal profit - no other positions taken lately, or in the portfolio. Feels OK to have low (or no) exposure at the moment given thelow activities in markets.

Have nice week!

Ps. I booked tickets to Vegas in August - will be great fun! Ds.

Sunday, 15 July 2012

Summer... :)

Hi!

Busy summer, busy at work, busy at home. Enough said, that is a luxury - so I will spare you from my whining.

Markets are typical for this time of the year, low liquidity and no real trends (except for Fixed Income - yields just continue downwards), well the Euro is still weakning but I dont want to chase it so far into a trend. In terms of macro, not good but not so bad either. It feels like we are in some sort of vacuum and I guess the real deal will start in Aug/Sep. Many leading indicators still declines - like the manufacturing index, but it more seems like a soft patch and jobs data are still quite robust. I am suprised that volatility is so low (VIX is megalow when comparing to earlier periods when risky assets are in a decline). Earnings season have started off in a good way, with JPMorgon coming strong on Friday - but investors still dislike risky assets and the hunt for yield in Fixed Income push yields into negative readings. This is really no easy markets, and my favorite discipline in the Hedge Fund world have had a very tough and bumpy summer. CTA's (systematic strategies) posted losses as high as -5%/-6% on the last day of June, and they were not the only ones. This have been a good period for testing my model, and I can soon book my first half year (early August) with a profit - atleast as it looks right now. I am very pleased, and motivation have been high lately even though time is scarce when combining a hectic life on work and still wanting time for all the social events popping up during summer.

So, I have spent hours (and some more hours) finishing a model I mentioned here a couple of months ago. It is a day-trading model which tries to capture moment Break-Outs. Testing looks promising, and I have actually traded on similar strategy at work a couple of years back (with good results).

See graph down below for 5 years of backtesting on EURUSD. (I will start to trade it in this contest this week). Don't put to much into to the different numbers on the x- and y-axis, rather judge it on the slope... :)

So, what about the competition?! It is still alive... Yes!

I tried some different positions in the discretionary portfolio lately - all tilted to a bounce back in risky assets but with no success: Long EurUsd, Long GbpUsd and Long CADJPY, the last two were stopped out while I closed the first one only after one day due to price action and change of signal on my fundamental indicator.

I am currently square, but I can promise you that I will have taken on new positons before the week is over. :)

PnL-developments:

Finally - the algo:

It has been choppy lately, I have been forth and back the last two weeks in EurUsd, UsdSek and AudCad while the the positions versus Yen have been static (short UsdJpy, Short GbpJpy).

Current trades look like:

Short EURUSD

Short USDSEK

Short AUDCAD

Short GBPJPY

Short USDJPY

=> Majority of the positions performs in a risk-off scenario.

PnL:

Have a nice late night and lovely new week!

Busy summer, busy at work, busy at home. Enough said, that is a luxury - so I will spare you from my whining.

Markets are typical for this time of the year, low liquidity and no real trends (except for Fixed Income - yields just continue downwards), well the Euro is still weakning but I dont want to chase it so far into a trend. In terms of macro, not good but not so bad either. It feels like we are in some sort of vacuum and I guess the real deal will start in Aug/Sep. Many leading indicators still declines - like the manufacturing index, but it more seems like a soft patch and jobs data are still quite robust. I am suprised that volatility is so low (VIX is megalow when comparing to earlier periods when risky assets are in a decline). Earnings season have started off in a good way, with JPMorgon coming strong on Friday - but investors still dislike risky assets and the hunt for yield in Fixed Income push yields into negative readings. This is really no easy markets, and my favorite discipline in the Hedge Fund world have had a very tough and bumpy summer. CTA's (systematic strategies) posted losses as high as -5%/-6% on the last day of June, and they were not the only ones. This have been a good period for testing my model, and I can soon book my first half year (early August) with a profit - atleast as it looks right now. I am very pleased, and motivation have been high lately even though time is scarce when combining a hectic life on work and still wanting time for all the social events popping up during summer.

So, I have spent hours (and some more hours) finishing a model I mentioned here a couple of months ago. It is a day-trading model which tries to capture moment Break-Outs. Testing looks promising, and I have actually traded on similar strategy at work a couple of years back (with good results).

See graph down below for 5 years of backtesting on EURUSD. (I will start to trade it in this contest this week). Don't put to much into to the different numbers on the x- and y-axis, rather judge it on the slope... :)

So, what about the competition?! It is still alive... Yes!

I tried some different positions in the discretionary portfolio lately - all tilted to a bounce back in risky assets but with no success: Long EurUsd, Long GbpUsd and Long CADJPY, the last two were stopped out while I closed the first one only after one day due to price action and change of signal on my fundamental indicator.

I am currently square, but I can promise you that I will have taken on new positons before the week is over. :)

PnL-developments:

Finally - the algo:

It has been choppy lately, I have been forth and back the last two weeks in EurUsd, UsdSek and AudCad while the the positions versus Yen have been static (short UsdJpy, Short GbpJpy).

Current trades look like:

Short EURUSD

Short USDSEK

Short AUDCAD

Short GBPJPY

Short USDJPY

=> Majority of the positions performs in a risk-off scenario.

PnL:

Have a nice late night and lovely new week!

Sunday, 1 July 2012

Congrats Spain!

What a MACHINE - Spain!

I had my hopes for an Italian victory, but it wasn't even close.

A very short update, I am off to London tomorrow for a trading conference (focusing on Fixed Income), but will be back on Thursday. Sorry for my infrequent postings lately! But as I always say, I continue to take my signals every day eventhough I dont post here. I also managed to find some time to do some programming lately, I continue to validate a break-out model (looks promising)... More to come on that subject - hopefully. :)

The algo have had some diffuculties lately, but is still up significantly this year, see chart below.

The current positions look like;

Algo

Long EURUSD

Long AUDCAD

Short USDSEK

Short USDJPY

Short GBPJPY

So, all-in-all a quite mixed porfolio in terms of risk on/off.

Discr

No positions active but a new all-time high. :)

Lately I have tried to short GBPUSD (Stopped out with a loss of around USD -160) and go long EURUSD (profit of USD 250). The long EURUSD was based on that I thought way too much negative was priced into the price going into the EU summit (Merkel downplayed all market expectations in a clever way), but I was very close to ger stoppped out. I entered with two units, one at 1.25 and the other one at 1.2445, both with stops at 1.2395... Low was 1.2407. So very lucky indeed. I closed it early Friday at 1.2587. I wont take any new trades this week since I will be away.

Over and out!

I had my hopes for an Italian victory, but it wasn't even close.

A very short update, I am off to London tomorrow for a trading conference (focusing on Fixed Income), but will be back on Thursday. Sorry for my infrequent postings lately! But as I always say, I continue to take my signals every day eventhough I dont post here. I also managed to find some time to do some programming lately, I continue to validate a break-out model (looks promising)... More to come on that subject - hopefully. :)

The algo have had some diffuculties lately, but is still up significantly this year, see chart below.

The current positions look like;

Algo

Long EURUSD

Long AUDCAD

Short USDSEK

Short USDJPY

Short GBPJPY

So, all-in-all a quite mixed porfolio in terms of risk on/off.

Discr

No positions active but a new all-time high. :)

Lately I have tried to short GBPUSD (Stopped out with a loss of around USD -160) and go long EURUSD (profit of USD 250). The long EURUSD was based on that I thought way too much negative was priced into the price going into the EU summit (Merkel downplayed all market expectations in a clever way), but I was very close to ger stoppped out. I entered with two units, one at 1.25 and the other one at 1.2445, both with stops at 1.2395... Low was 1.2407. So very lucky indeed. I closed it early Friday at 1.2587. I wont take any new trades this week since I will be away.

Over and out!

Sunday, 24 June 2012

Vacation - all targets hit

Hi,

just a really short update since I have been away on vacation (Beautiful Sweden)...

For the ones following the blog more carefully, then you are aware that all my profit targets were hit this week. :) The positioning for stronger AUD realized, and both AUDCAD and EURAUD hit my targets of 1.04 and 1.24, respectively. Implying that the competition is acutally alive again, the discretionary portfolio is upp USD 1400 while the algo had suffered lately. I will do the graphical update as soon as I settled again.

But all in all - no positions active in the discretionary portfolio. I hope this will change the coming week, the JPY seems to be suffering a bit lately and I may consider following the trend.

over and out (When Sweden is out of the cup, well then Goooo Italy)

just a really short update since I have been away on vacation (Beautiful Sweden)...

For the ones following the blog more carefully, then you are aware that all my profit targets were hit this week. :) The positioning for stronger AUD realized, and both AUDCAD and EURAUD hit my targets of 1.04 and 1.24, respectively. Implying that the competition is acutally alive again, the discretionary portfolio is upp USD 1400 while the algo had suffered lately. I will do the graphical update as soon as I settled again.

But all in all - no positions active in the discretionary portfolio. I hope this will change the coming week, the JPY seems to be suffering a bit lately and I may consider following the trend.

over and out (When Sweden is out of the cup, well then Goooo Italy)

Sunday, 17 June 2012

The Greek tragedy

Hi folks!

Sorry for not posting for a while, but don't worry I continue to update my models day after day, year after year (atleast day after day). The Greek election could potentially have major implications on markets but I am cautiously optimistic as I think New Democrazy will win but it is close to a coin-flip. I have tried to be prudent and reduced some holdings in the discretionary portfolio before the weekend (-1 unit of AUDCAD). Actually, the discretionary portfolio have had a nice development latley, as my call for a stronger AUD has played out and also being lucky trading EURUSD in a profitable way after the Spanish bank aid request (sold on the sunday above 1.26 and then turned the position to a long below 1.25).

The algo have seen som volatility lately, but the discretionary book have been off-setting this in a nice way.

I also tried the short USDSEK at the same time as I shorted EURUSD but decided to stop it out early.

Else, I still think AUD could strengthen a bit further, macro and fundamentals continue to be supportive.

Positions:

Discretionaty portfolio: (New all-time high, above USD 1100)

Short EURAUD (Entry 1.292, stop at 1.282, target 1.24)

Long AUDCAD (Entry 1.0057, target 1.04, stop at 1.012) - reduced one unit at 1.026

Algo:

Long EURUSD (from 1.2505)

Short USDSEK (from 7.13)

Short USDJPY

Short GBPJPY

Short AUDCAD

Have a nice week!

Sorry for not posting for a while, but don't worry I continue to update my models day after day, year after year (atleast day after day). The Greek election could potentially have major implications on markets but I am cautiously optimistic as I think New Democrazy will win but it is close to a coin-flip. I have tried to be prudent and reduced some holdings in the discretionary portfolio before the weekend (-1 unit of AUDCAD). Actually, the discretionary portfolio have had a nice development latley, as my call for a stronger AUD has played out and also being lucky trading EURUSD in a profitable way after the Spanish bank aid request (sold on the sunday above 1.26 and then turned the position to a long below 1.25).

The algo have seen som volatility lately, but the discretionary book have been off-setting this in a nice way.

I also tried the short USDSEK at the same time as I shorted EURUSD but decided to stop it out early.

Else, I still think AUD could strengthen a bit further, macro and fundamentals continue to be supportive.

Positions:

Discretionaty portfolio: (New all-time high, above USD 1100)

Short EURAUD (Entry 1.292, stop at 1.282, target 1.24)

Long AUDCAD (Entry 1.0057, target 1.04, stop at 1.012) - reduced one unit at 1.026

Algo:

Long EURUSD (from 1.2505)

Short USDSEK (from 7.13)

Short USDJPY

Short GBPJPY

Short AUDCAD

Have a nice week!

Wednesday, 6 June 2012

Sell in May and then go away...

So, the old saying "Sell in May and then go away" have been true so far on the equity markets... May was a horrible month for risky assets in general, and maybe not a major surprise in hindsight given the detoriating macro and political outlook. However, this is the environment where my FX macro model is designed to benefit the most, and thus acting as a hedge to a portfolio tilted to "long-only"... And so it did. I have now been trading it live for four months and the performance and robustnees have (so far ) been stronger than expected. I expect it to have a tough ride when investment sentiment appear in markets again, but I try to enjoy while it last... Markets gives and takes, and adopting a objective systematic trading strategy can be really relaxing sometimes.

I have also taken control of my discretionary portfolio again and the Short EurAud entered earlier now have a friend, namely a long position in AudCad. I entered it on the 1st of June at 1.00575 on the back of central bank expectations, markets expected Bank of Australia to cut with -1.3% the coming year while Bank of Canada was expected to increase rates with 0.1%... I thought this was overdone, and I had to try a long position given the low of the year in this cross. Actually, I took on a position three times my regulary due to strong conviction. It has played out good so far, but I try to stay objective and have therefor already reduced 1/3 (at 1.0194) and moved my stop to entry. So, my take for now, and given strong GDP from Australia is for a stronger AUD... I am tempted to short JPY as well (as usual), but are still sidelined. Especially a long postion in SEK vs. JPY looks very interesting longer term! (Take a look on a chart)

Performance update, see graphs... I have included a comparison to equities in a try to show the diversification effect.

The discretionary portfolio - a gain of USD 450 since the last update (thanks to Aussie)

I have also taken control of my discretionary portfolio again and the Short EurAud entered earlier now have a friend, namely a long position in AudCad. I entered it on the 1st of June at 1.00575 on the back of central bank expectations, markets expected Bank of Australia to cut with -1.3% the coming year while Bank of Canada was expected to increase rates with 0.1%... I thought this was overdone, and I had to try a long position given the low of the year in this cross. Actually, I took on a position three times my regulary due to strong conviction. It has played out good so far, but I try to stay objective and have therefor already reduced 1/3 (at 1.0194) and moved my stop to entry. So, my take for now, and given strong GDP from Australia is for a stronger AUD... I am tempted to short JPY as well (as usual), but are still sidelined. Especially a long postion in SEK vs. JPY looks very interesting longer term! (Take a look on a chart)

Performance update, see graphs... I have included a comparison to equities in a try to show the diversification effect.

The FX algorithm - in %

That's all for this time folk's!

Ps. Positioning...

Algo:

Long USDSEK

Short EURUSD

Short GBPJPY

Short USDPY

Short AUDCAD

"try-out"

Long EURCAD

Short AUDNZD

Disccretionary:

Short EURAUD (target 1.24, stop 1.292)

Long AUDCAD (target 1.04, stop 1.0058)

Ds.

Tuesday, 29 May 2012

How can the sky be blue when Spain is falling off a cliff?!

Hi,

sorry for a late weekly update... I have been away over the weekend due to the holiday - I took the oppurtunity to visit my mother in the northeast of Skåne. Far from any financial market and European crisis... Perspective is necessary these days (and all days!).

The algo continue to performs well which means that it have produced yet another high. What is also worth mention is that I have started to trade two more currencies based on my macro model - namely AUDNZD and EURCAD. I will include these as a seperate time series in the future as I don't see them belong to my core portfolio (due to different reasons, one being high transactions costs). The latest return series can be found below... Enjoy! I'll do while it is still happy days... I will always hit a new drawdown further down the road - so I try to enjoy when the sky is blue and the wine tastes a little bit better than usual...

I still run the same positions as the last update,

Short EurUsd

Long UsdSek

Short AudCad

Short UsdJpy

Short GbpJpy

The new test-currencies:

Short AudNzd

Long EurCad (a bit of whip-saw the former week)

The discretionary portfolio

I started to trade again (Up approx. USD 100 since last update) - the follwing positons were taken on last week,

Long UsdJpy (long 80.12, stopped out the day after at 79.38)

Short UsdCad (Short 1.0176, stopped out the day after at 1.0245)

Short EurAud (Short 1.2921, took profit of 1/3 at 1.2738, target 1.24 and stop moved down to 1.292)

That is all for this time! Happy trading

sorry for a late weekly update... I have been away over the weekend due to the holiday - I took the oppurtunity to visit my mother in the northeast of Skåne. Far from any financial market and European crisis... Perspective is necessary these days (and all days!).

The algo continue to performs well which means that it have produced yet another high. What is also worth mention is that I have started to trade two more currencies based on my macro model - namely AUDNZD and EURCAD. I will include these as a seperate time series in the future as I don't see them belong to my core portfolio (due to different reasons, one being high transactions costs). The latest return series can be found below... Enjoy! I'll do while it is still happy days... I will always hit a new drawdown further down the road - so I try to enjoy when the sky is blue and the wine tastes a little bit better than usual...

I still run the same positions as the last update,

Short EurUsd

Long UsdSek

Short AudCad

Short UsdJpy

Short GbpJpy

The new test-currencies:

Short AudNzd

Long EurCad (a bit of whip-saw the former week)

The discretionary portfolio

I started to trade again (Up approx. USD 100 since last update) - the follwing positons were taken on last week,

Long UsdJpy (long 80.12, stopped out the day after at 79.38)

Short UsdCad (Short 1.0176, stopped out the day after at 1.0245)

Short EurAud (Short 1.2921, took profit of 1/3 at 1.2738, target 1.24 and stop moved down to 1.292)

That is all for this time! Happy trading

Sunday, 20 May 2012

Falling equites - rising portfolio

Hi!

What a week... Volatility is creeping back again after some tranquil months in the start of the year. It sure doesn't look sexy out there - equities are still somewhat contained eventhough S&P are tumbled to four-month low and Eurostoxx even worse... But when lookin to rates then you get some perspective. German 10-year bond yields down to 1.4%, meaning that investors are looking in negative real yields for ten years at a rate of 1.4%...! Of course, all eyes are on Spain and Greece with more to come the coming weeks... But it doesn't feel the same as it did during 2008, people are more "used" to negative news... I guess this is reality where we will see modest growth for years to come, but still growth... In that environment I dont want to own bonds with 1.4% yield, I would prefer equites or corporate credits... However, I have the luxury to invest in FX... And I much rather invest my money there. :)

The last week was a good stress test of my algo, it is somewhat designed to make money when equties continue to slide... And so it did, even to an extent I never though was possible... It feels that I continue to repeat myself, but the performance are way above what I ever dreamt of. See graph below for volatility adjusted perforance...

No update on the discretionary portfolio since it is empty... My view regarding SEK played out, but I am still is not up and running with the "firepower" as I want on my new account... Money on the way but these things take longer time than I thought. However, I am a bit sceptical to enter into short SEK positions at these levels.

Algo:

Short EURUSD

Short GBPJPY

Short USDJPY

Long USDSEK

Short AUDCAD

The current portfolio set up is very sensitive to a sudden change of investor sentiment as it is 100% tilted to "risk-off", so increased volatility can be expected!

What a week... Volatility is creeping back again after some tranquil months in the start of the year. It sure doesn't look sexy out there - equities are still somewhat contained eventhough S&P are tumbled to four-month low and Eurostoxx even worse... But when lookin to rates then you get some perspective. German 10-year bond yields down to 1.4%, meaning that investors are looking in negative real yields for ten years at a rate of 1.4%...! Of course, all eyes are on Spain and Greece with more to come the coming weeks... But it doesn't feel the same as it did during 2008, people are more "used" to negative news... I guess this is reality where we will see modest growth for years to come, but still growth... In that environment I dont want to own bonds with 1.4% yield, I would prefer equites or corporate credits... However, I have the luxury to invest in FX... And I much rather invest my money there. :)

The last week was a good stress test of my algo, it is somewhat designed to make money when equties continue to slide... And so it did, even to an extent I never though was possible... It feels that I continue to repeat myself, but the performance are way above what I ever dreamt of. See graph below for volatility adjusted perforance...

Algo:

Short EURUSD

Short GBPJPY

Short USDJPY

Long USDSEK

Short AUDCAD

The current portfolio set up is very sensitive to a sudden change of investor sentiment as it is 100% tilted to "risk-off", so increased volatility can be expected!

Sunday, 13 May 2012

Another high...!

Hi!

Back from a tough weekend up in the north... 21107m of running... But it was great fun and I already want to sign up for next year. I realized that I have post more and more seldom here, but atleast I've kept my weekly posts. I guess that is how it will look like in the future as well due to time constrains. I will do one post per week (atleast) where I update you on the current developments in terms of PnL and give some short market comments.

The algo managed to take old the old highs once again mostly on the back of the weaker SEK, and the last three months have been fantastic when one remember the volatile equity-markets... :)

It is time to ship in more money... I've found a new brokes which seems much more reliable than my current, I want to stay objective but I can atleast mentioned that it has been around for many years...

On a negative note: I have been stopped out of all my discretionary bets (Still up USD 187 since inception), which leaves me with a square book and I will be a bit picky going forward given time constrains... My current view are that SEK will weaken even more than what it has already been doing the last week. Markets starts to price cuts in Sweden, and I agree... The weak industrial production in combination with an inlation than runs at 1.3% year-on-year should make the Riksbanken afraid that Sweden are entering a nasty deflationary scenario. I think there are more potential in this move, but I won't do anything before I got everything settled at my new broker.

Current equity-curve algo:

Current positions:

Short EURUSD

Short USDJPY

Long GBPJPY (been sig-sawed once the last week)

Long USDSEK

Short AUDCAD

Have a nice week!

Back from a tough weekend up in the north... 21107m of running... But it was great fun and I already want to sign up for next year. I realized that I have post more and more seldom here, but atleast I've kept my weekly posts. I guess that is how it will look like in the future as well due to time constrains. I will do one post per week (atleast) where I update you on the current developments in terms of PnL and give some short market comments.

The algo managed to take old the old highs once again mostly on the back of the weaker SEK, and the last three months have been fantastic when one remember the volatile equity-markets... :)

It is time to ship in more money... I've found a new brokes which seems much more reliable than my current, I want to stay objective but I can atleast mentioned that it has been around for many years...

On a negative note: I have been stopped out of all my discretionary bets (Still up USD 187 since inception), which leaves me with a square book and I will be a bit picky going forward given time constrains... My current view are that SEK will weaken even more than what it has already been doing the last week. Markets starts to price cuts in Sweden, and I agree... The weak industrial production in combination with an inlation than runs at 1.3% year-on-year should make the Riksbanken afraid that Sweden are entering a nasty deflationary scenario. I think there are more potential in this move, but I won't do anything before I got everything settled at my new broker.

Current equity-curve algo:

Current positions:

Short EURUSD

Short USDJPY

Long GBPJPY (been sig-sawed once the last week)

Long USDSEK

Short AUDCAD

Have a nice week!

Sunday, 6 May 2012

New model developed

Hi,

I hope all the readers living in the Nordics enjoyed the sunny weekend... I am a bit tired after having participated in a 10km run yesterday, I managed to do it on 50 minutes which is 2 minutes better than my target... :) The big test comes next week when I will participate in a 21km run in Sweden.

In temrs of tradings, I have spent way too little time in sharing my developments and models too you for different reasons mentioned before - one being the obvious of keeping any kind of edge secret. But I thought I would try to tell you a little bit more about a model I spent quite some time on lately. Actually, I have traded on a similiar model a couple of years ago, but I now have much more data verify it (1-minute data from 2005) on so I've tried to verify my old findings which I traded on fixed income and equity indices to also work on FX... the results looks promising, please see graph below. :)

Y-axis is percentage, so 0.4 = 40%, X-axis is number of trades, meaning on average one trade per day since 2005. Blue line is without comissions and slippage while it is included for the the red line.

It is a very simple short-term trend-follwing model... The concept is based on the same principles as one of my favorite-traders used/uses, Toby Crabel. It is based on volatility break-outs, meaning that I take on a position when an asset trades above or below a certain threshold (with stops applied) and then holds it to the next time frame (usually the opening time each day).

Rules:

Long an asset if: Price > (Opening price + Volatility threshold)

if long stop placed: entry - stop threshold

Short an asset if: Price < (Opening price - Volatility threshold)

if short stop placed: entry + stop threshold

Exit: If not stopped out the following day at open

Position sizing due to a fixed fraction of your portfolio.

...

Very simple model, but still powerful. Few people will be able to consistent trade this rules day in and day out due to its simplicity... So, I actually don't mind sharing it and hope you find it interesing. :)

I still need to do sime more tests, increasing the time-horizon slightly in a try to reduce the costs and test on multiple assets... I have done the developments in Matlab, it is not easy to process 2 millions rows of data in Excel...

Have a lovely weekend!

I hope all the readers living in the Nordics enjoyed the sunny weekend... I am a bit tired after having participated in a 10km run yesterday, I managed to do it on 50 minutes which is 2 minutes better than my target... :) The big test comes next week when I will participate in a 21km run in Sweden.

In temrs of tradings, I have spent way too little time in sharing my developments and models too you for different reasons mentioned before - one being the obvious of keeping any kind of edge secret. But I thought I would try to tell you a little bit more about a model I spent quite some time on lately. Actually, I have traded on a similiar model a couple of years ago, but I now have much more data verify it (1-minute data from 2005) on so I've tried to verify my old findings which I traded on fixed income and equity indices to also work on FX... the results looks promising, please see graph below. :)

Y-axis is percentage, so 0.4 = 40%, X-axis is number of trades, meaning on average one trade per day since 2005. Blue line is without comissions and slippage while it is included for the the red line.

It is a very simple short-term trend-follwing model... The concept is based on the same principles as one of my favorite-traders used/uses, Toby Crabel. It is based on volatility break-outs, meaning that I take on a position when an asset trades above or below a certain threshold (with stops applied) and then holds it to the next time frame (usually the opening time each day).

Rules:

Long an asset if: Price > (Opening price + Volatility threshold)

if long stop placed: entry - stop threshold

Short an asset if: Price < (Opening price - Volatility threshold)

if short stop placed: entry + stop threshold

Exit: If not stopped out the following day at open

Position sizing due to a fixed fraction of your portfolio.

...

Very simple model, but still powerful. Few people will be able to consistent trade this rules day in and day out due to its simplicity... So, I actually don't mind sharing it and hope you find it interesing. :)

I still need to do sime more tests, increasing the time-horizon slightly in a try to reduce the costs and test on multiple assets... I have done the developments in Matlab, it is not easy to process 2 millions rows of data in Excel...

Have a lovely weekend!

Saturday, 5 May 2012

Algo - new all-time-high!

Hi!

Sorry for not posting anything so far this week... Workload have been quite extensive and a lot of things to attend outside work. Some good news, the "algo" has broken through its old all-time-high which feels really satisfactory given what have happend in markets lately - global equities are down and FX-markets are characterized by narrow range-trading. In addition, I have made some progress on the development front, more on this tomorrow... And some bad news, the discrenationary portfolio have had a rough ride lately and are now down to only USD 258... The distance between the discretionary and the algo is increasing.

Some short reflections on markets: Global macro continue to detoriate, PMI's declines more-than-expected in Europe and austerity really bites... US non-farm payrolls yesterday disappointed and growth seems quite distance at the moment - especially in Europe. But, things dont seem's to fall off a cliff, I guess this muddle-through will continue. Australia lowered rates with 0.5%, and markets still discount another 0.75% cuts for the coming year while markets price in atleast one hike in Canada. It looks like there can still be some decent moves in the FX-space on the back of monetary policies from the smaller central banks although the major cental banks are on hold. I am still slightly constructive on risky assets as I still thinks investors needs return, not only capital preservation, but that view have been expensive in the discretionary portfolio.

Latest update:

In terms of USD - not adjusted for different nominal sizes due to volatility - Algo USD 2242, Discr. USD 258

Positions:

Algo:

Short EURUSD (from 1,3222, stop 1,3418)

Short USDJPY

Long GBPJPY

Short AUDCAD

Long USDSEK (I have had a problem with my broker, they stopped to support USDSEK so I will change broker this week, very annoying...)

Disc:

Closed the last unit in the long AUDNZD at 1,2822

Stopped out my long CADJPY at 80,38

Remaining position:

Long EURUSD (stop at 1,3045)

Good luck dear readers!

Sorry for not posting anything so far this week... Workload have been quite extensive and a lot of things to attend outside work. Some good news, the "algo" has broken through its old all-time-high which feels really satisfactory given what have happend in markets lately - global equities are down and FX-markets are characterized by narrow range-trading. In addition, I have made some progress on the development front, more on this tomorrow... And some bad news, the discrenationary portfolio have had a rough ride lately and are now down to only USD 258... The distance between the discretionary and the algo is increasing.

Some short reflections on markets: Global macro continue to detoriate, PMI's declines more-than-expected in Europe and austerity really bites... US non-farm payrolls yesterday disappointed and growth seems quite distance at the moment - especially in Europe. But, things dont seem's to fall off a cliff, I guess this muddle-through will continue. Australia lowered rates with 0.5%, and markets still discount another 0.75% cuts for the coming year while markets price in atleast one hike in Canada. It looks like there can still be some decent moves in the FX-space on the back of monetary policies from the smaller central banks although the major cental banks are on hold. I am still slightly constructive on risky assets as I still thinks investors needs return, not only capital preservation, but that view have been expensive in the discretionary portfolio.

Latest update:

In terms of USD - not adjusted for different nominal sizes due to volatility - Algo USD 2242, Discr. USD 258

Positions:

Algo:

Short EURUSD (from 1,3222, stop 1,3418)

Short USDJPY

Long GBPJPY

Short AUDCAD

Long USDSEK (I have had a problem with my broker, they stopped to support USDSEK so I will change broker this week, very annoying...)

Disc:

Closed the last unit in the long AUDNZD at 1,2822

Stopped out my long CADJPY at 80,38

Remaining position:

Long EURUSD (stop at 1,3045)

Good luck dear readers!

Wednesday, 25 April 2012

Post-FOMC

Hi,

I have been lucky lately which means that my total portfolio value is up to a new all-time-high of USD 4800...! That was not what I expected when I started in early Feb with USD 2000... :) But, that is how it works, markets give and it takes - I always try to take more when it gives and leave less when it takes... I wish it was that easy...

So, what has happened lately?! Macro continues to disappoint with the flash PMI's out from Europe being horribel, actually the German one was down to the levels not seens since 2009... I guess this is a signal that the austerity in Europe really bites and with that follows less trading within the Eurozone. The Chinese flash PMI (manufacturing data) was also a bit weak, but atleast better than expected. That in combination with the political uncertainity from France and the Nehterlands saw equities fall off cliff on monday... down around -3%. With the Spanish IBEX down to levels not seen since 2003... And, in all this mess I still want to be long EURUSD! Isn't it fascinating that EURUSD hasn't traded lower? (for reasons mentioned in previous posts)... So, I went long EURUSD on both the discretionaty book and the algo book on Monday respectively Sunday. I will keep this positions as for now while I reduced half om my long position in AUDNZD following tonights' FOMC confernce as that cross have seen a decent rebound since the lows and as my convinction is somewhat decreased.

Positions as of today:

Discretionary

It has been a good week so far as all positions have performed, current value USD 550

Long EURUSD (at 1.3152, stop at 1.3065 and target 1.3390)

Long AUDNZD (reduced half at 1.2714)

Long CADJPY

Algo

New all-time-high today (18% return), and in absolute terms without taking into account different weights USD 2250

Long EURUSD (done at 1.3192)

Long GBPJPY

Short USDJPY

Short AUDCAD

Short USDSEK

I have been lucky lately which means that my total portfolio value is up to a new all-time-high of USD 4800...! That was not what I expected when I started in early Feb with USD 2000... :) But, that is how it works, markets give and it takes - I always try to take more when it gives and leave less when it takes... I wish it was that easy...

So, what has happened lately?! Macro continues to disappoint with the flash PMI's out from Europe being horribel, actually the German one was down to the levels not seens since 2009... I guess this is a signal that the austerity in Europe really bites and with that follows less trading within the Eurozone. The Chinese flash PMI (manufacturing data) was also a bit weak, but atleast better than expected. That in combination with the political uncertainity from France and the Nehterlands saw equities fall off cliff on monday... down around -3%. With the Spanish IBEX down to levels not seen since 2003... And, in all this mess I still want to be long EURUSD! Isn't it fascinating that EURUSD hasn't traded lower? (for reasons mentioned in previous posts)... So, I went long EURUSD on both the discretionaty book and the algo book on Monday respectively Sunday. I will keep this positions as for now while I reduced half om my long position in AUDNZD following tonights' FOMC confernce as that cross have seen a decent rebound since the lows and as my convinction is somewhat decreased.

Positions as of today:

Discretionary

It has been a good week so far as all positions have performed, current value USD 550

Long EURUSD (at 1.3152, stop at 1.3065 and target 1.3390)

Long AUDNZD (reduced half at 1.2714)

Long CADJPY

Algo

New all-time-high today (18% return), and in absolute terms without taking into account different weights USD 2250

Long EURUSD (done at 1.3192)

Long GBPJPY

Short USDJPY

Short AUDCAD

Short USDSEK

Sunday, 22 April 2012

Weekly update

Hello FX-world!

This week was a pleasent one in terms of USD returns, with GBPJPY being a strong contribution... Strong retail sales and and a reversal of the QE saw the GBP go stronger. It also seems like it was a good decision to close the short position in EURUSD with strong price-action on Friday. Actually, I have had a long signal generated on EURUSD for the first time since I started this blog... Very interesting indeed, and my sense is that positioning is very light for a higher EURUSD (supportive for my trade)... I will try to long this one on the discretionary portfolio as well.

Peformance stills looks strong for the algo (figure on the top) and also the discretionary portfolio managed to post positive numbers...

In terms of USD;

Algo USD 2131 (new high!)

Disc USD 381

Positions:

Algo

Short EURUSD (will change to long as soon as the markets open)

Short USDJPY

Long GBPJPY

Short USDSEK

Short AUDCAD

Disc

Long AUDNZD

Long CADJPY

Long EURUSD (when markets open, going for 2 figures, stops 1.4 figures lower)

Have a nice week!

This week was a pleasent one in terms of USD returns, with GBPJPY being a strong contribution... Strong retail sales and and a reversal of the QE saw the GBP go stronger. It also seems like it was a good decision to close the short position in EURUSD with strong price-action on Friday. Actually, I have had a long signal generated on EURUSD for the first time since I started this blog... Very interesting indeed, and my sense is that positioning is very light for a higher EURUSD (supportive for my trade)... I will try to long this one on the discretionary portfolio as well.

Peformance stills looks strong for the algo (figure on the top) and also the discretionary portfolio managed to post positive numbers...

In terms of USD;

Algo USD 2131 (new high!)

Disc USD 381

Positions:

Algo

Short EURUSD (will change to long as soon as the markets open)

Short USDJPY

Long GBPJPY

Short USDSEK

Short AUDCAD

Disc

Long AUDNZD

Long CADJPY

Long EURUSD (when markets open, going for 2 figures, stops 1.4 figures lower)

Have a nice week!

Thursday, 19 April 2012

Hello, where are you trends?

Hi,

markets are very range-bounds for the moment - which can be quite frustrating with my kind of trading... It is really a relative war out there, with all major countries trying to downplay the value of its currency (Japanese BoJ-member constantly trying weaken the yen by verbal intervention)... And, EurUsd continues to hold the stance despite all bad news out from Europe... Spain falling off a cliff, and even semi-core countries like France and the Netherlands widening in an unhealthy matter. Quite some worrisome developments, but no effect on the Euro... That is why I today decided to close my short EurUsd (sold at 1.3270, closed at 1.3132) since I believe that the capital flows from European countries coming from outside the Eurozone (due to closing down non-core branches etc and taking the money back to the Eurozone) will continue as the deleveraring cycle still has a far way to go. Macro has only a minor impact at the moment. But, I have a sell-order in place if we break below 1.2970 since I believe we will have significant stop-moves from dealers and corporates seeing 1.30 as a big support. Else, Bank of Canada was quite hawkish this week and thus yields have moved up => I have gone long CADJPY...

Current positons:

Discrentionary:

Long AUDNZD*2

Long CADJPY (81.94, stop at 80.45 target 84.2)

Algo

Short EURUSD

Long GBPJPY

Short USDJPY

Short USDSEK

Short AUDCAD

Still no change of signals in AUDNZD and EURCAD

Have a nice time the rest of the week!

Ps. The portfolio value stands at USD 4425 despite the choppy environment Ds.

markets are very range-bounds for the moment - which can be quite frustrating with my kind of trading... It is really a relative war out there, with all major countries trying to downplay the value of its currency (Japanese BoJ-member constantly trying weaken the yen by verbal intervention)... And, EurUsd continues to hold the stance despite all bad news out from Europe... Spain falling off a cliff, and even semi-core countries like France and the Netherlands widening in an unhealthy matter. Quite some worrisome developments, but no effect on the Euro... That is why I today decided to close my short EurUsd (sold at 1.3270, closed at 1.3132) since I believe that the capital flows from European countries coming from outside the Eurozone (due to closing down non-core branches etc and taking the money back to the Eurozone) will continue as the deleveraring cycle still has a far way to go. Macro has only a minor impact at the moment. But, I have a sell-order in place if we break below 1.2970 since I believe we will have significant stop-moves from dealers and corporates seeing 1.30 as a big support. Else, Bank of Canada was quite hawkish this week and thus yields have moved up => I have gone long CADJPY...

Current positons:

Discrentionary:

Long AUDNZD*2

Long CADJPY (81.94, stop at 80.45 target 84.2)

Algo

Short EURUSD

Long GBPJPY

Short USDJPY

Short USDSEK

Short AUDCAD

Still no change of signals in AUDNZD and EURCAD

Have a nice time the rest of the week!

Ps. The portfolio value stands at USD 4425 despite the choppy environment Ds.

Sunday, 15 April 2012

Weekly update - post Easter

Hi!

This week was a very busy one at work, so not a lot of focus of further development the recent days... I continue to follow my daily routines in terms of updating my models according to new signals, but that is it for the moment.

Markets lately have been characterized by range-bound behaviour, and it is really a tug-of war given the major currencies. Macro has continued to come in a bit week, also in the US. But, I still believe the USD looks a bit more interesting relative to the other majors, so I keep my stance for stronger dollar.

Below, the usual update in terms of graphs...

The bad trend in the discretionary portfolio continues... :( While the discretionary portfolio feels really solid - also when considering that equities have performed quite bad lately.

In terms of USD:

Total USD 4180

Algo: USD 1868

Disc: USD 352

Positionwise... I have added to my long AUDNZD position and now runs twice the original size in the discretionary portfolio. I keep my long USDJPY with the stop at 80.40 and the short EURUSD with a stop at 1.3270 and a target below 1.29...

Discr:

Long USDJPY

Short EURUSD

Long AUDNZD

Algo...

I have been forth and back in USDSEK and USDJPY the last week, and the current positioning looks like:

Short EURUSD

Short USDSEK (6,7965)

Short AUDCAD

Long USDJPY (will change to a short position when markets open)

Short GBPJPY

Have a nice one!

This week was a very busy one at work, so not a lot of focus of further development the recent days... I continue to follow my daily routines in terms of updating my models according to new signals, but that is it for the moment.

Markets lately have been characterized by range-bound behaviour, and it is really a tug-of war given the major currencies. Macro has continued to come in a bit week, also in the US. But, I still believe the USD looks a bit more interesting relative to the other majors, so I keep my stance for stronger dollar.

Below, the usual update in terms of graphs...

The bad trend in the discretionary portfolio continues... :( While the discretionary portfolio feels really solid - also when considering that equities have performed quite bad lately.

In terms of USD:

Total USD 4180

Algo: USD 1868

Disc: USD 352

Positionwise... I have added to my long AUDNZD position and now runs twice the original size in the discretionary portfolio. I keep my long USDJPY with the stop at 80.40 and the short EURUSD with a stop at 1.3270 and a target below 1.29...

Discr:

Long USDJPY

Short EURUSD

Long AUDNZD

Algo...

I have been forth and back in USDSEK and USDJPY the last week, and the current positioning looks like:

Short EURUSD

Short USDSEK (6,7965)

Short AUDCAD

Long USDJPY (will change to a short position when markets open)

Short GBPJPY

Have a nice one!

Monday, 9 April 2012

Model trading

As promised... I haven't had so much focus on sharing my models for you - the readers... To be honest - I don't want to share too much since I am a big believer of my models and the "edge" I believe they have... I have been doing this for four years now, spending hundreds (probably thousand) of hours developing/thinking/analyzing different trading approaches... I love this, not for the sake of the money, but for the challenge and the satisfaction it gives when I feel I have understood something a little better. I think this is an ever changing environment, and one can always learn more... The hunt for perfections never stops - that's why I have developed more than 100 models, but only a few feels good enough to trade live in my view. One who has made the cut is the one I am trading on in this challenge.

I will try to describe a little bit better what is behind the model:

The model, let us call it the FX-macro, is based on the relative economic strength between different countries... The rationale are the following, if a country (A) has a strong economic development (increasing GDP, declining unemployment...) vs. a country (B) with weak development (declining GDP, increasing unemployment) then investors should be more interested to invest in A than in B. Since the FX-market is all about demand and supply, then the currency corresponding to country A should be in demand (inflow of capital) while country B's currency should be well supplied (outflow) - implying that the currency A/B should increase in value... What kind of indicator do I use for the economic development in different countries? I use assets from outside the FX-world - mostly rates. This works for me, but somelse may be better off using equities or something else... So, to sum up, if a country is expanding relative to other countries, than it is quite likely that I will be a buyer of the corresponding currency.

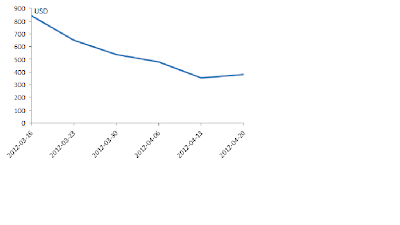

I just wanted to include two graphs - highlighting the usual problems as a model trader...

I currently validates an intraday momentum-model which I have developed a couple of years ago... The first graph shows the result when I start in the morning while the other in the afternoon... The difference in result is huge! This seems a bit fishy... :) The first graph is beautiful... Something is wrong, I haven't found out yet (will take some time to go through all code), but this is a usual situation when developing - "learning by burning"...

I will try to describe a little bit better what is behind the model:

The model, let us call it the FX-macro, is based on the relative economic strength between different countries... The rationale are the following, if a country (A) has a strong economic development (increasing GDP, declining unemployment...) vs. a country (B) with weak development (declining GDP, increasing unemployment) then investors should be more interested to invest in A than in B. Since the FX-market is all about demand and supply, then the currency corresponding to country A should be in demand (inflow of capital) while country B's currency should be well supplied (outflow) - implying that the currency A/B should increase in value... What kind of indicator do I use for the economic development in different countries? I use assets from outside the FX-world - mostly rates. This works for me, but somelse may be better off using equities or something else... So, to sum up, if a country is expanding relative to other countries, than it is quite likely that I will be a buyer of the corresponding currency.

I just wanted to include two graphs - highlighting the usual problems as a model trader...

I currently validates an intraday momentum-model which I have developed a couple of years ago... The first graph shows the result when I start in the morning while the other in the afternoon... The difference in result is huge! This seems a bit fishy... :) The first graph is beautiful... Something is wrong, I haven't found out yet (will take some time to go through all code), but this is a usual situation when developing - "learning by burning"...

Happy Easter - weekly update

Hi!

I hope you have enjoyed some days off! I have had some busy days, which means that I haven't had time to finish some of my development projects... However, I will today post twice, first the weekly update and then a post focusing on the models...

So, see below for the regular weekly update... The first graph is the development of my algo on a daily basis as %. The second graph is the development of the discretionary portfolio starting three weeks ago and updating weekly...

The devlopment for the discretionary porfolio is declining hefty, now down to "only" USD 481 while the algo is up towards a new high (USD 1839) => total profit USD 4280

My model-based approach has worked really good given the declining equity markets - eventhough I have been short USDSEK and long USDJPY, which usually declines when risky assets drop. I hadn't expected this decline in risky assets when taking into acccount the macro developments worldwide. Manufacturing orders came in strong globally except for Europe, and consumers continue to be relative optimistic. However, the weak payrolls report on Friday was a bit worrisome and the detoriating development in Spain - I guees we will have a volatile ride the coming week. I still believe the USD looks relative stronger than the other majors, but I still want yields to be supportive so I keep an open stance at the moment. Else, I have been stopped out from a long position in EURCHF twice, I still believe in the case, but it is also quite obvious that many others share my view... So I keep a square position at the moment. I believe that EURUSD will trend lower (US looks relative stronger than the Eurozone, which can be seen in the manufacturing production and the genereal macro-outlook).

To sum up:

Discretionary positions

Long USDJPY (stop at 80.40, entered at 79.56)

Short EURUSD (Moved stop down to entry-level, 1.3270 and target down to 1.2835)

Long AUDNZD (Traded at 6 months low, feels a bit "overdone" given the stronge correlation to China)

Algo

Long USDJPY (quite likely to have a sell-signal generated tomorrow)

Short GBPJPY

Short EURUSD

Long USDSEK (entered at 6.7734)

Short AUDCAD

Have a wonderful week!

I hope you have enjoyed some days off! I have had some busy days, which means that I haven't had time to finish some of my development projects... However, I will today post twice, first the weekly update and then a post focusing on the models...

So, see below for the regular weekly update... The first graph is the development of my algo on a daily basis as %. The second graph is the development of the discretionary portfolio starting three weeks ago and updating weekly...

The devlopment for the discretionary porfolio is declining hefty, now down to "only" USD 481 while the algo is up towards a new high (USD 1839) => total profit USD 4280

My model-based approach has worked really good given the declining equity markets - eventhough I have been short USDSEK and long USDJPY, which usually declines when risky assets drop. I hadn't expected this decline in risky assets when taking into acccount the macro developments worldwide. Manufacturing orders came in strong globally except for Europe, and consumers continue to be relative optimistic. However, the weak payrolls report on Friday was a bit worrisome and the detoriating development in Spain - I guees we will have a volatile ride the coming week. I still believe the USD looks relative stronger than the other majors, but I still want yields to be supportive so I keep an open stance at the moment. Else, I have been stopped out from a long position in EURCHF twice, I still believe in the case, but it is also quite obvious that many others share my view... So I keep a square position at the moment. I believe that EURUSD will trend lower (US looks relative stronger than the Eurozone, which can be seen in the manufacturing production and the genereal macro-outlook).

To sum up:

Discretionary positions

Long USDJPY (stop at 80.40, entered at 79.56)

Short EURUSD (Moved stop down to entry-level, 1.3270 and target down to 1.2835)

Long AUDNZD (Traded at 6 months low, feels a bit "overdone" given the stronge correlation to China)

Algo

Long USDJPY (quite likely to have a sell-signal generated tomorrow)

Short GBPJPY

Short EURUSD

Long USDSEK (entered at 6.7734)

Short AUDCAD

Have a wonderful week!

Tuesday, 3 April 2012

Bingo! FOMC-minutes

Hello,

The FOMC minutes released this evening supports my case for stronger USD as the members are less convinced that further policy measures are needed given the current state of the economy. Price-action the last week(s), meaning weaker dollar, points to a belief that further quantitative easing (QE3) would be realitiy, which has also been visible in the declining yields lately. This will probably now change. I think that the information out tonight could potentially lead to a continued increase in yields short/medium term, which means that I continue to see a fundamental case for stronger dollar. So, no change to my current positioning (Long USDJPY, short EURUSD).

The total portfolio value at this time: USD 4254 :) - a good number eventhough I have been stopped out of USDJPY a couple of times lately... (I need to place my stops outside the obvious support-areas)

Have a nice easter!

The FOMC minutes released this evening supports my case for stronger USD as the members are less convinced that further policy measures are needed given the current state of the economy. Price-action the last week(s), meaning weaker dollar, points to a belief that further quantitative easing (QE3) would be realitiy, which has also been visible in the declining yields lately. This will probably now change. I think that the information out tonight could potentially lead to a continued increase in yields short/medium term, which means that I continue to see a fundamental case for stronger dollar. So, no change to my current positioning (Long USDJPY, short EURUSD).

The total portfolio value at this time: USD 4254 :) - a good number eventhough I have been stopped out of USDJPY a couple of times lately... (I need to place my stops outside the obvious support-areas)

Have a nice easter!

Sunday, 1 April 2012

Arghh... Sunday pushed my stop

Hi...!

A bit annoyed at the moment. Markets just opened, and my stop on EURCHF was triggered just because it was a wide bid/offer spread on open (I had used a trigger on bid, I will never do that again).

Anyways, I had a great weekend... Hopefully you did as well. :)

Short recap, see updated P/L for the algo down below.

Algo: USD 1480

Discr. USD 548

As you can see, the algo increased the lead last week... I have to come up with something special quite soon. :)

Well, marketswise...The Japanese fiscal year has just ended, and the usual saying is that is usually bad news for the Yen. I am not sure about that, but all my models are pointing to weaker fundamentals for the Yen - USDJPY continues to look interesting with still quite solid macro in the US. So, I keep my call for stronger USD vs. JPY.

Positions:

Discretionary:

Long 2*USDJPY (I was stopped out on position this week, but just added another here at 83.04 - stop 81,97, target 84,75)

Short EURUSD

Long EURCHF (added a new position after my annoying stop - still stop at 1,2022 but trigger on offer)

Algo.

Long USDJPY

Short AUDCAD

Short EURUSD

Short USDSEK

Short GBJPY (just went short 132,984 after three days of whip-saw, and for once a profitable whip-saw)...

That's all for this time...

A bit annoyed at the moment. Markets just opened, and my stop on EURCHF was triggered just because it was a wide bid/offer spread on open (I had used a trigger on bid, I will never do that again).

Anyways, I had a great weekend... Hopefully you did as well. :)

Short recap, see updated P/L for the algo down below.

Algo: USD 1480

Discr. USD 548

As you can see, the algo increased the lead last week... I have to come up with something special quite soon. :)

Well, marketswise...The Japanese fiscal year has just ended, and the usual saying is that is usually bad news for the Yen. I am not sure about that, but all my models are pointing to weaker fundamentals for the Yen - USDJPY continues to look interesting with still quite solid macro in the US. So, I keep my call for stronger USD vs. JPY.

Positions:

Discretionary:

Long 2*USDJPY (I was stopped out on position this week, but just added another here at 83.04 - stop 81,97, target 84,75)

Short EURUSD

Long EURCHF (added a new position after my annoying stop - still stop at 1,2022 but trigger on offer)

Algo.

Long USDJPY

Short AUDCAD

Short EURUSD

Short USDSEK

Short GBJPY (just went short 132,984 after three days of whip-saw, and for once a profitable whip-saw)...

That's all for this time...

Thursday, 29 March 2012

Month-end (and Qtr)

Hi!

Fun to see that more and more people starts to follow my blog...!

Short update due to a busy agenda... and prolonged spa-weekend in Germany tomorrow. :)

Discretionary portfolio:

I went short EurUsd as stated in the last update, the timing could have been better, but so far it seems like my stop will survive. The case is still intact so I will leave it as it is.

Short EURUSD 1.3269 (stop 1.3435 and target 1.3030)

In addition, I went long EURCHF (double size) at 1.2060 on the case that I think speculation of intervention will keep it above 1.2040... Stop at 1.2022, target 1.2124 and 1.25

Lastly, I went long USDJPY today at 82.34 with a stop at 81.94 and target 82.90 due to the fact that 82 seems like a strong support, and if we break below I dont wont to stay in the trade. Secondly, fundamentals still support the trade (rates US vs. JPY still in an uptrend) so I think this trade short-term provide decent risk-reward.

Summary:

Short EURUSD

Long 2*EURCHF

Long 2*USDJPY

Algo:

I have had a short signal in USDSEK and GBPJPY since the last update. These were executed at 6.6649 and 131.626 respectively.

Summary:

Short EURUSD

Long USDJPY

Short AUDCAD

Short USDSEK

Short GBPJPY

P/L has moved sidways and now stands at USD 3784

Have a loverly weekend

Ps. Month-end and Qtr-end often provides increased volatility... And remember that the Japanese fiscal year ends tomorrow. Ds.

Fun to see that more and more people starts to follow my blog...!

Short update due to a busy agenda... and prolonged spa-weekend in Germany tomorrow. :)

Discretionary portfolio:

I went short EurUsd as stated in the last update, the timing could have been better, but so far it seems like my stop will survive. The case is still intact so I will leave it as it is.

Short EURUSD 1.3269 (stop 1.3435 and target 1.3030)

In addition, I went long EURCHF (double size) at 1.2060 on the case that I think speculation of intervention will keep it above 1.2040... Stop at 1.2022, target 1.2124 and 1.25

Lastly, I went long USDJPY today at 82.34 with a stop at 81.94 and target 82.90 due to the fact that 82 seems like a strong support, and if we break below I dont wont to stay in the trade. Secondly, fundamentals still support the trade (rates US vs. JPY still in an uptrend) so I think this trade short-term provide decent risk-reward.

Summary:

Short EURUSD

Long 2*EURCHF

Long 2*USDJPY

Algo:

I have had a short signal in USDSEK and GBPJPY since the last update. These were executed at 6.6649 and 131.626 respectively.

Summary:

Short EURUSD

Long USDJPY

Short AUDCAD

Short USDSEK

Short GBPJPY

P/L has moved sidways and now stands at USD 3784

Have a loverly weekend

Ps. Month-end and Qtr-end often provides increased volatility... And remember that the Japanese fiscal year ends tomorrow. Ds.

Sunday, 25 March 2012

Earnings volatility

Hi!

The last week was a poor one in terms of profit generation (quite the opposite, declining portfolio value). You never know when profits and losses will hit your position, but I have expected quite some volatility, that is just part of the business... :)

If you have followed my positions closely, maybe you noticed that I moved my target in USDJPY a bit higher... In hindsight, that was not especially wise! My orginal plan would have been spot on (target 83.95), instead I saw my profit vaporize and becoming a loss. Since I am not trading while I am at work, this kind of reverse movements will be a part of my daily profits and losses...

Please see below for the updated returns for the last week

Current update:

Discretionary portfolio: USD 650 (down from 841 from the week before)

Algo: USD 1080 (down from 1391)

I have also decided to include two more currency pairs, namely AUDNZD and EURCAD. Hopefully helping diversification, I been a bit too much tilted against USD and JPY, now I have more equal exposure towards JPY, USD, AUD, EUR and CAD.

Discr.

Long USDJPY (stop at 80.40)

Algo.

Long USDJPY

Long GBPJPY

Long USDSEK

Short AUDCAD

Short EURUSD

Waiting for change of signals in AUDNZD and EURCAD

Finally, some short comments about my thoughts about the last week... I think it was a bit scary to see the sharp drop in the global manufacturing data, and the last weeks risk-off moves have made investors aware of that eventhough there were a huge liquidity injection, the structural problems are still not solved over a short period of time. So, that is why I will go short EURUSD in the discrenationary portfolio, USD should benefit vs. EUR, and I think the risk-reward looks favorable to the downside.

Have a lovely week!

The last week was a poor one in terms of profit generation (quite the opposite, declining portfolio value). You never know when profits and losses will hit your position, but I have expected quite some volatility, that is just part of the business... :)

If you have followed my positions closely, maybe you noticed that I moved my target in USDJPY a bit higher... In hindsight, that was not especially wise! My orginal plan would have been spot on (target 83.95), instead I saw my profit vaporize and becoming a loss. Since I am not trading while I am at work, this kind of reverse movements will be a part of my daily profits and losses...

Please see below for the updated returns for the last week

Current update:

Discretionary portfolio: USD 650 (down from 841 from the week before)

Algo: USD 1080 (down from 1391)

I have also decided to include two more currency pairs, namely AUDNZD and EURCAD. Hopefully helping diversification, I been a bit too much tilted against USD and JPY, now I have more equal exposure towards JPY, USD, AUD, EUR and CAD.

Discr.

Long USDJPY (stop at 80.40)

Algo.

Long USDJPY

Long GBPJPY

Long USDSEK

Short AUDCAD

Short EURUSD

Waiting for change of signals in AUDNZD and EURCAD

Finally, some short comments about my thoughts about the last week... I think it was a bit scary to see the sharp drop in the global manufacturing data, and the last weeks risk-off moves have made investors aware of that eventhough there were a huge liquidity injection, the structural problems are still not solved over a short period of time. So, that is why I will go short EURUSD in the discrenationary portfolio, USD should benefit vs. EUR, and I think the risk-reward looks favorable to the downside.

Have a lovely week!

Tuesday, 20 March 2012